| Copyright © 2018 Jones Lang LaSalle, IP, Inc |

|

|

|

|

|

| China is home to more than 200 million people who rent their homes, adding up to a rental market with a value estimated to exceed one trillion yuan. Renters’ growing numbers and evolving tastes helping a new rental housing market to thrive. JLL has released a whitepaper assessing the rise of China's rental housing market, with case studies of six major cities including Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou and Chengdu. |

State of the market |

| The path ahead |

| Investment market performance |

| China’s rental housing market is growing rapidly, supported by favourable demographics, rising barriers to home ownership, supportive policies, and an influx of capital. |

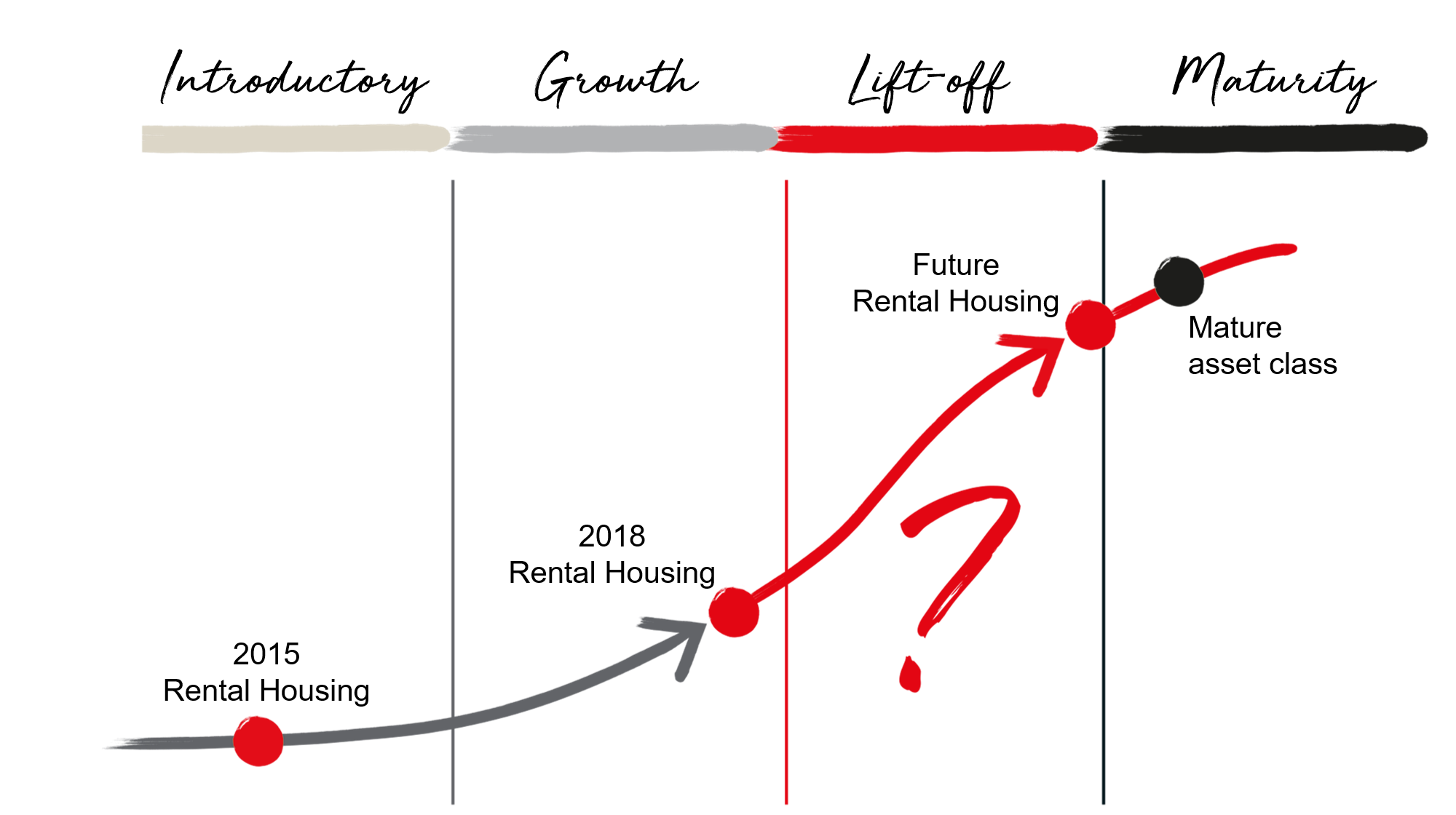

| Rapid development has lifted China’s rental housing market from its “introductory phase” and through most of its “growth phase.” The market is now set to enter a “lift off phase.” |

| Rental housing in mature markets is an investment-grade asset that offers clear advantages to investors. China’s rental housing investment market is still developing, but expected to get a boost. |

| Key takeaways |

|

|

|

|

JLL WeChat |

JLL Mini-Program |

JLL Weibo |

| For more information, please contact: |

|

|